Our ambition

As an investor and owner, we ambition to move from a position of only tackling ESG considerations from a risk management perspective to becoming a positive SDGs contributor. This translates into our investment strategy as follows:

As an investor

Sofina supports sustainable finance and targets investments in companies active in our four sectors of focus and which have a net positive impact on SDGs, either (i) through their products or services (defined as the “What” dimension) or (ii) through the way they operate (defined as the “How” dimension). At the level of Sofina Private Funds, Sofina targets General Partners that incorporate ESG into their investment strategy and operations.

As an owner

Sofina supports its portfolio companies in their journey to improve their ESG performance and contribution to the SDGs through (i) their products or services and/or (ii) the way they operate.

Implementation of our commitments

To achieve our ambition and comply with the UNPRI, we incorporate ESG into our entire decision-making process, formalised in a Responsible Investment Policy covering Sofina Direct and Sofina Private Funds.

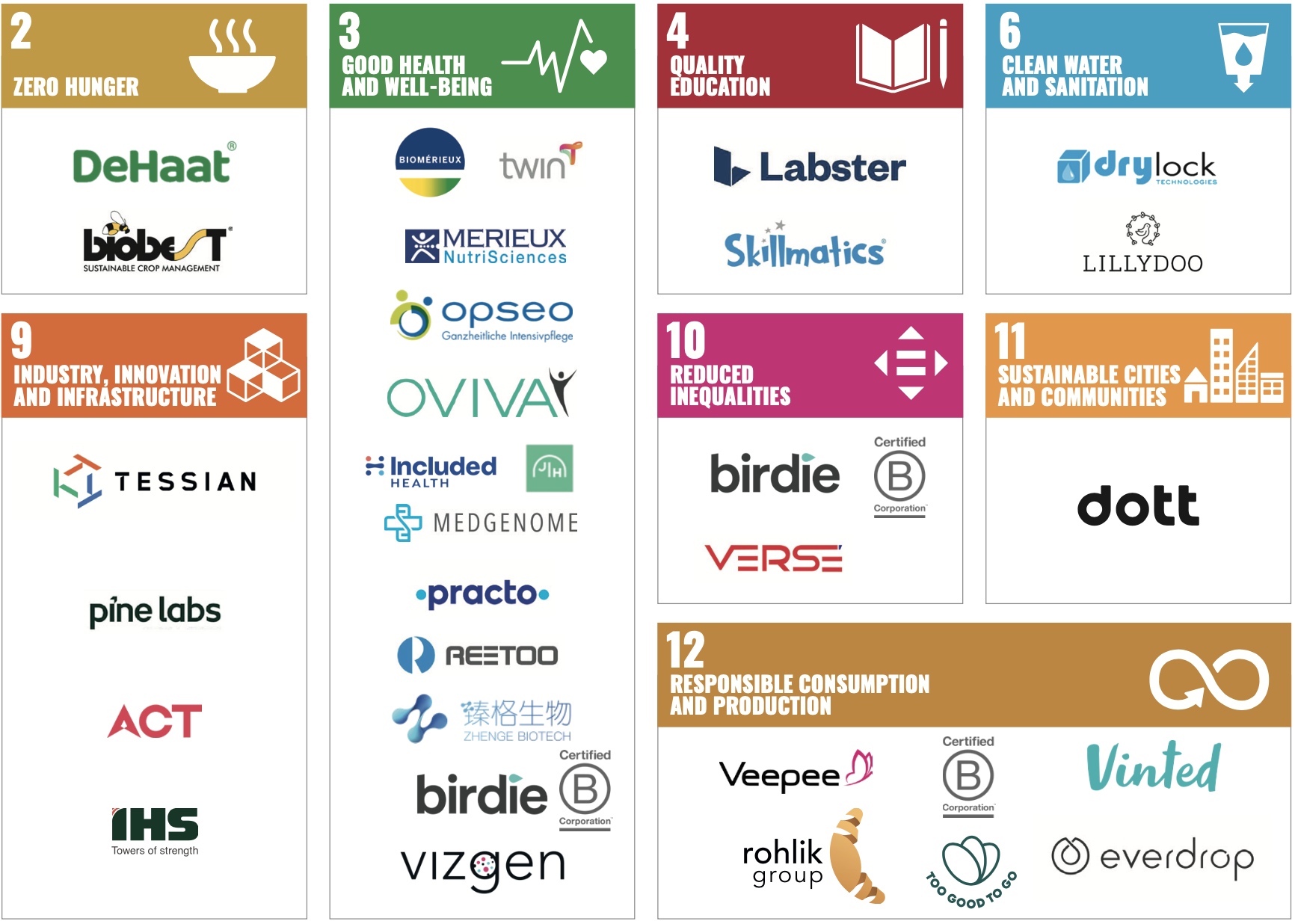

Mapping of our portfolio companies having products and services that directly positively contribute to the SDGs (last update : June 2023):