A family-run

investment company

4+ Sectors of focus

Consumer and retail

Digital transformation

Education

Healthcare and life sciences

EUR 7.7 bn

market capitalisation⁽²⁾

3 complementary investment styles

Sofina direct

Sofina private funds

125+ years

Root going back

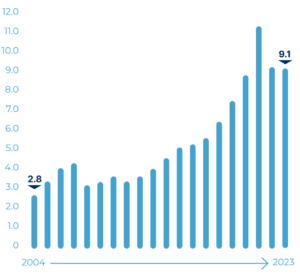

Net Asset Value(3)

Change over the last 20 years

3 regions

Offices in Brussels, Luxembourg and Singapore

87

employees

across our 3 offices

(1) Based on the fair value of the Sofina group’s investments at 31 December 2023 (portfolio in transparency, i.e. considering all portfolio investments whether held by Sofina SA directly or indirectly through its investment subsidiaries).

(2) At 31 December 2023.

(3) Data at 31 December. The financial data have been prepared under IFRS standards since the financial year ending 31 December 2004. Figures relating to 2016 and 2017 have been restated in accordance with IAS 28, §18 to ensure that the Net Asset Value for 2016 and 2017 can be compared with that of the following years as prepared under the Investment Entity status.